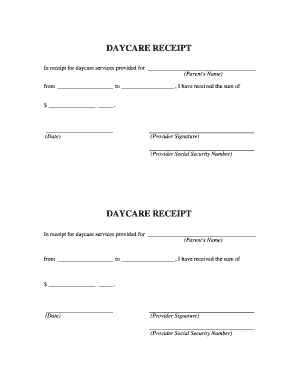

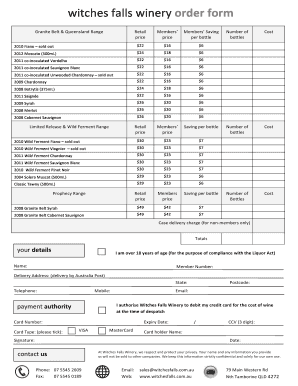

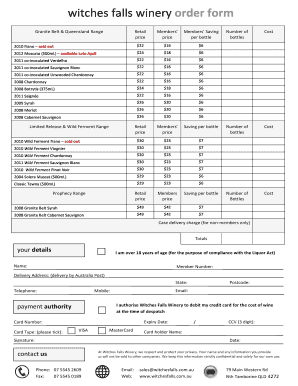

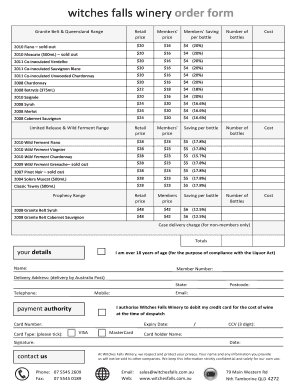

Get the free child care receipt

Show details

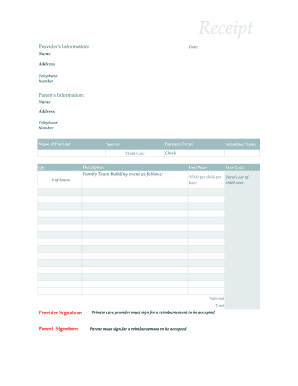

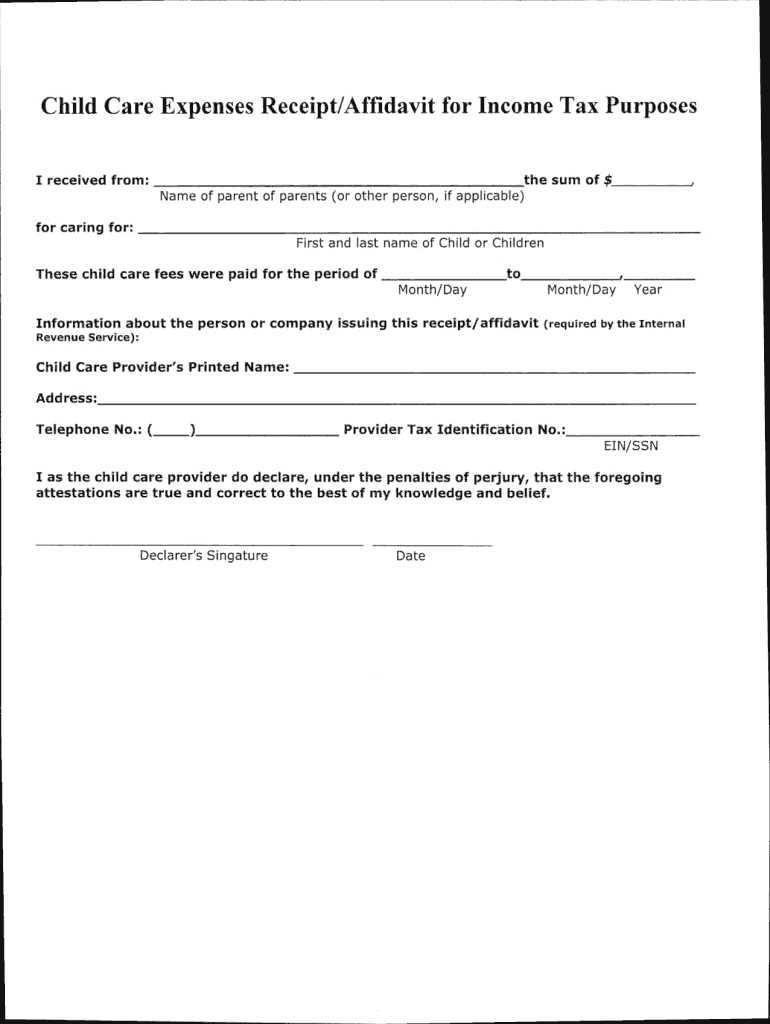

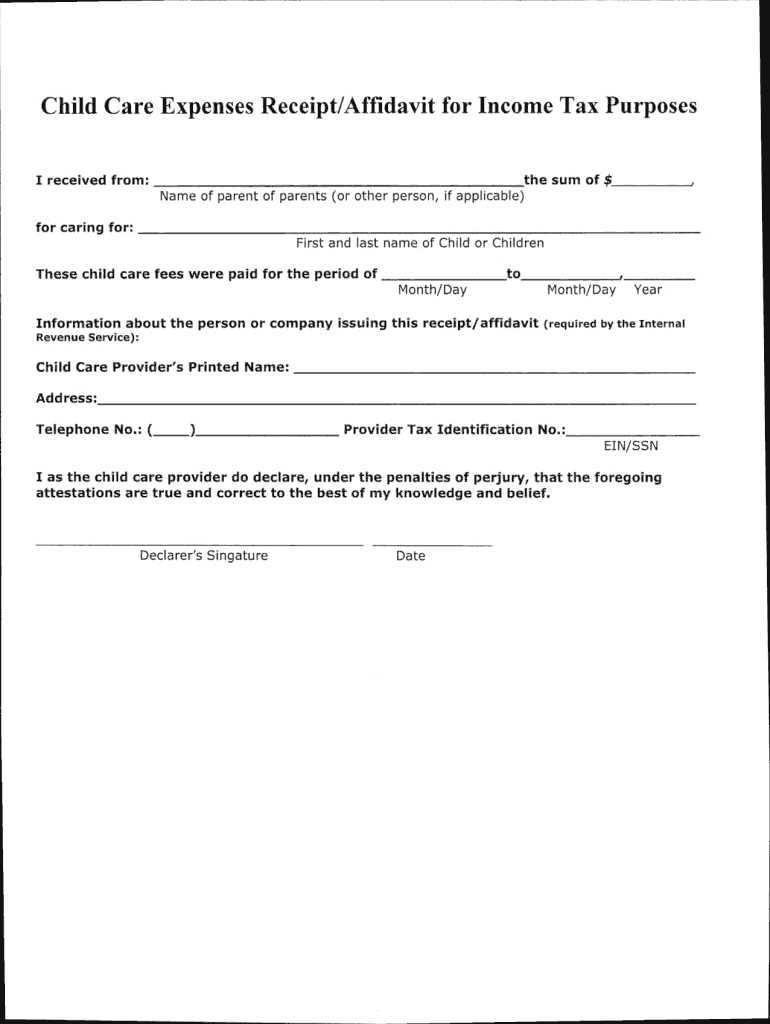

Child Care Expenses Receipt/Affidavit for Income Tax Purposes I received from: the sum of $ Name of parent of parents (or other person, if applicable) for caring for: First and last name of Child

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign daycare receipt form

Edit your child care receipt template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your daycare receipt template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit child care receipt pdf online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit printable daycare receipt form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out daycare expense form

How to fill out Child Care Expenses Receipt/Affidavit for Income Tax Purposes

01

Obtain the Child Care Expenses Receipt/Affidavit form from the official website or your tax professional.

02

Fill in your personal details, including your name, address, and Social Insurance Number (SIN).

03

Provide the name and address of the child care provider.

04

Include the total amount paid for child care services for the tax year.

05

Specify the periods during which the child care services were used.

06

If applicable, include the names and birth dates of the children who received care.

07

Sign and date the affidavit to certify that the information provided is accurate.

08

Keep a copy of the completed form for your records and submit it with your income tax return.

Who needs Child Care Expenses Receipt/Affidavit for Income Tax Purposes?

01

Parents or guardians who are claiming child care expenses on their income tax returns.

02

Individuals who have paid for child care services in order to work, attend school, or conduct research.

03

Taxpayers eligible to take advantage of child care expense deductions or credits in their tax filings.

Fill

child care receipts

: Try Risk Free

People Also Ask about childcare tax form

When should I expect my tax refund 2023?

Most people with no issues on their tax return should receive their refund within 21 days of filing electronically if they choose direct deposit.

Are tax refunds delayed 2023?

The IRS is warning of weekslong and even monthslong delays in 2023 for mailed-in taxes. If you mailed in your taxes and are waiting for your refund, the IRS says not to file a second time and not to call.

When can I expect tax return?

Refunds are generally issued within 21 days of when you electronically filed your tax return, and longer for paper returns.

What tax return means?

A tax return is a form or forms filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

How to get a tax refund?

You can request a tax refund from the government by filing an annual tax return. This document reports how much money you earned, expenses, and other important tax information. And it will help you to calculate how many taxes you owe, schedule tax payments, and request a refund when you have overpaid.

Is it better to owe or get a refund?

“The best strategy is breaking even, owing the IRS an amount you can easily pay, or getting a small refund,” Clare J. Fazackerley, CPA, CFP, told Finance Buzz. “You don't want to owe more than $1,000 because you'll have an underpayment penalty of 5% interest, which is more than you can make investing the money.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit child care tax statement online?

With pdfFiller, it's easy to make changes. Open your babysitter receipt template in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete proof of child care expenses on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your child care receipt for tax purposes, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit nanny receipt template on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute how to make a receipt for babysitting from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Child Care Expenses Receipt/Affidavit for Income Tax Purposes?

A Child Care Expenses Receipt/Affidavit is a document used for reporting and claiming child care expenses when filing income taxes. It serves as proof of payment and details the amounts spent on child care services.

Who is required to file Child Care Expenses Receipt/Affidavit for Income Tax Purposes?

Parents or guardians who incur child care expenses while earning income, attending school, or carrying out research are required to file the Child Care Expenses Receipt/Affidavit for tax purposes.

How to fill out Child Care Expenses Receipt/Affidavit for Income Tax Purposes?

To fill out the receipt/affidavit, individuals must provide their personal information, details of the child care provider, amounts paid, and relevant dates. It's important to retain receipts as proof of the expenses claimed.

What is the purpose of Child Care Expenses Receipt/Affidavit for Income Tax Purposes?

The purpose of the Child Care Expenses Receipt/Affidavit is to enable taxpayers to claim deductions for eligible child care expenses, thereby reducing their taxable income and tax liability.

What information must be reported on Child Care Expenses Receipt/Affidavit for Income Tax Purposes?

The information that must be reported includes the name and address of the child care provider, the amount paid for child care, dates of service, the names of children receiving care, and the taxpayer's identification details.

Fill out your Child Care Expenses ReceiptAffidavit for Income Tax Purposes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dependent Child Care is not the form you're looking for?Search for another form here.

Keywords relevant to child care expenses tax

Related to babysitting letter for taxes

If you believe that this page should be taken down, please follow our DMCA take down process

here

.